Payroll Management

Payroll Management: Efficient Ways

For a small business started in the garage, it can be a novelty to hire staff. Payroll is just one of many tasks that small businesses have to handle as they grow from the spare room or garden shed.

Payroll is not as easy as many would wish. It’s a simple idea – you need a system to pay your staff on time and correctly, without costing your business astronomical amounts.

Payroll management can be done in three ways. First, you can create and manage your payroll system in-house. This includes everything from gathering employee data to manually paying super to each member of staff. Outsourcing the entire process to a professional is the second option. This can be an accounting or payroll company with the necessary experience, but they will charge accordingly. Third option: pay a consultant who will help you create a payroll system that you can easily manage or delegate to a member of your staff in the future.

There are many obligations that a business owner has, both towards employees and the tax office. These obligations must be met to avoid any penalties. If you are aware of these obligations and can track their evolution over time, managing payroll effectively and efficiently shouldn’t be a problem.

Payroll management in-house

First, decide if you can manage payroll in-house or if it is safer to outsource completely.

Clair Couttie is a human resources partner at fibre. She says, “You should consider a few factors here.” Do you have the knowledge and skills to comply with all legal, tax and labour relations issues related to payroll?

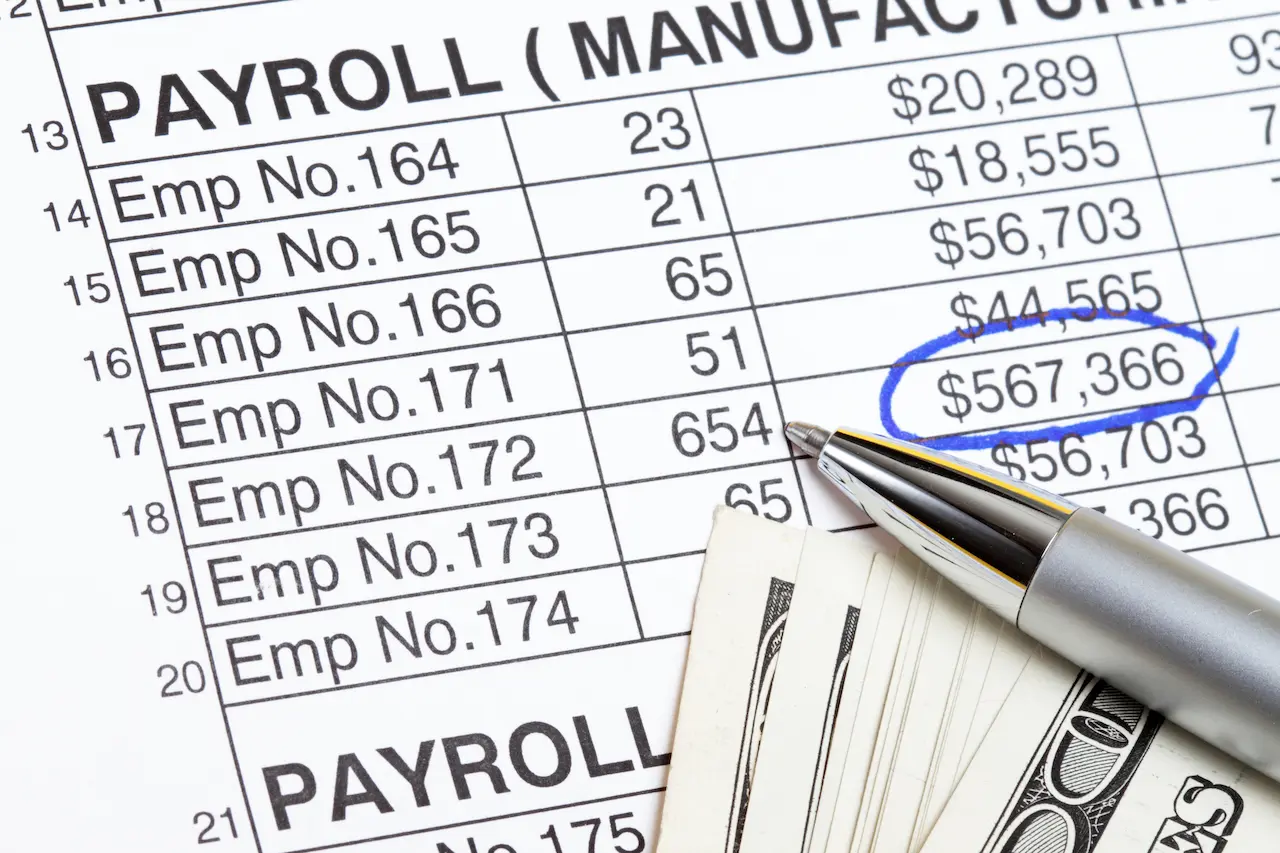

You have more control when you manage payroll yourself. This also involves keeping track of the variables that affect each employee’s wages – superannuation contributions, PAYG tax contributions, and annual and sick leave allowances. It becomes more difficult to manage your employees’ obligations as you hire more.

If you do your payroll in-house you will have more time to process it and make any manual payments. “You can manage payroll whenever and however you like because you are in control of everything,” says Couttie. It can be difficult if you do not have the capability and don’t know the legal, taxation and industrial relations implications.

First, you should ensure that your business is compliant with the Fair Work Ombudsman’s awards. The Fair Work Ombudsman says that an award is a document which outlines minimum conditions of employment and terms for a specific type of employee. The award specifies the minimum wage a worker is entitled to, depending on his or her job. It also outlines other entitlements, such as leave tax and pensions.

“Every award is different, and, depending on each state, different again,” says David Henderson, founder of DavidHendersonOnline.com. Most states are governed by the Fair Work Act, but certain transitional elements and industries come into play.

The Ombudsman offers an online award Finder that allows you to find the awards relevant to your company.

It is important to be aware of changes in employee obligations over time. It’s easy to keep only a few employees. But as you grow, it becomes more difficult.

Are you notified when the award increases? If you don’t keep up with the latest developments in industrial relations, it could affect how much you pay your employees. As a small company, you may be unknowingly underpaying employees and violating many industrial relations laws.

A major challenge of handling payroll internally is accurately and consistently documenting each employee’s figures. A mistake in the employee’s leave entitlements or the PAYG amount can lead to unforeseen costs.

Stuart McLeod is the general manager for payroll at Xero. He says that many people have trouble tracking leave accruals. They also struggle to ensure the correct amount of leave has been accrued by the statutory requirements. “Each employee who is paid a salary gets four weeks of leave that are accrued during the time they work. The employee has also accrued 10 days of sick leave. “Make sure you track the records and deduct it as soon as it is taken.”

Taxation and Superannuation

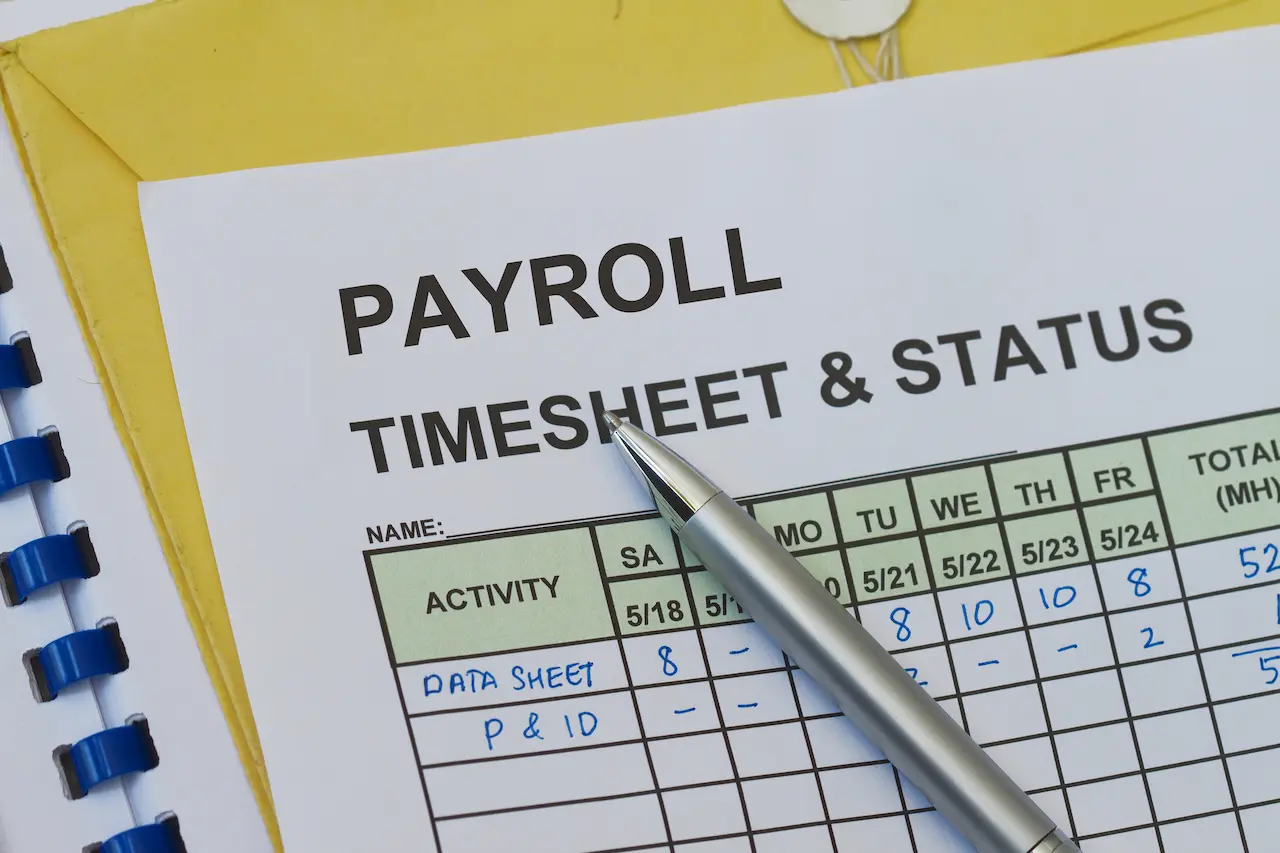

After identifying the awards that are relevant to your company, it is time to think about how to pay them. This mechanism involves managing the PAYG tax obligations of each employee. The business must pay tax on every dollar that is paid to an employee, based on the award or salary bracket of the employee. This tax is calculated every week, depending on the number of hours that each employee worked.

Henderson says that a small shop would need to keep track of what each employee does each day to pay them at the end of each week. As they change their rates each week, so does the tax, due to the variable dollar amount and the hours worked.

It is easier for companies to use this method if they pay their staff by salary rather than hourly.

“If I consider my staff, we have never changed our salaries,” Henderson says that they are paid the same amount every week, month or fortnight because they don’t get overtime. From a practical perspective, all we do is set up a direct debit once a month for the next 26 weeks. We don’t touch the money after that.

If you fail to pay your PAYG correctly or pay it after the due date, you may be subjected to serious penalties and interest.

Payroll managers also have to be aware of superannuation, which is a major financial obligation. Superannuation is calculated simply – the minimum amount of 9% must be paid to employees unless they have agreed otherwise. The business must pay it quarterly. Each employee will have their own superannuation funds, each with its own unique method of payment.

McLeod, from Xero, says that you must use BPay in order to pay into your super fund. Many of them require you to log in to their portals to inform them which payment period was accrued and to whom it applies. It can be quite a hassle to do this every quarter. There are penalties for paying late.

Payroll software

You shouldn’t rely on Excel spreadsheets and self-made systems to track the different aspects of payroll. It’s worth investing in software to automate payments and catalogue data if you don’t want to hire a payroll service.

McLeod, from Xero, says that if you do it manually you are putting yourself and your business at risk. You might not be protecting yourself as much or as well as you think you are.

Accounting software such as MYOB or Xero can automate many tasks that managers must perform. Reach Accounting and other cloud-based accounting software offer similar services. They are usually more streamlined with fewer features but can be integrated easily into existing systems using APIs.

There are many different systems. Some track annual leave, long service leave, and sick leave. Henderson says that the basic ones are not as good at tracking this or make it more difficult. If you are only employing casuals and will not be paying annual leave to them, then you do not need to upgrade to the next level. If you are paying annual leave, sick leave and holidays, then you will need to be able to track them. If you have less than six employees, a simple Excel sheet may work. As you grow, it becomes more complex.

Outsourcing and Consulting

The best way to avoid outsourcing your payroll to a third party is to hire a consultant who can help you create a system in the beginning. It is a good way to eliminate bad habits and get you started on the right path with regards to payroll practices.

If you do not think you are capable of running your payroll, you may want to consider outsourcing it. “There are many payroll providers that offer cost-effective consulting services,” says fibreHR’s Couttie. Some payroll outsourcing providers offer a mix of services. They may offer inexpensive payroll software that can be managed in-house, by a bookkeeper for example.

It is best to leave the payroll process to a professional accountant who has experience in this area. It is the best solution, but it is also the most expensive. Do your research and find out how much the management company will cost you. Be sure to get value for your money.

Couttie says, “I recommend you review the coverage of their service.” Will they notify you of any award increases so that you can adjust staff wages to ensure compliance, for example? As part of their services, do they offer an advice line where you can ask questions about the award coverage or pay rates? Is it possible to upload payroll data directly into the system? Is the system capable of automating leave processes? Your payroll provider can only provide a transactional service without these services.”

Most small businesses will find it easier to manage their payroll and accounting in-house, with the help of a professional set-up. This will often depend on how many employees you have.

McLeod, from Xero, says: “If you have more than a few people on your payroll, I’d always recommend getting your accountant to set it up for you.” It’s better to set it up right the first time than to try to correct it later. It’s also less expensive in the long term.